Bristol County Tax Calculator

Quickly calculate property taxes in Bristol County with our free online tool, ideal for homeowners, real estate agents, and tax professionals.

Check It Yourself

About This Tool

Our Bristol County Tax Calculator is a user-friendly online tool designed to provide fast and accurate property tax estimates. Simply input your property’s assessment value, select exemption types and property class, and enter the local mill rate to receive detailed tax calculations instantly.

This tool benefits homeowners, real estate professionals, and financial advisors seeking quick insights into property tax liabilities and assessments in Bristol County. It features comprehensive calculations for exemptions, assessments, and effective tax rates, helping users make informed decisions.

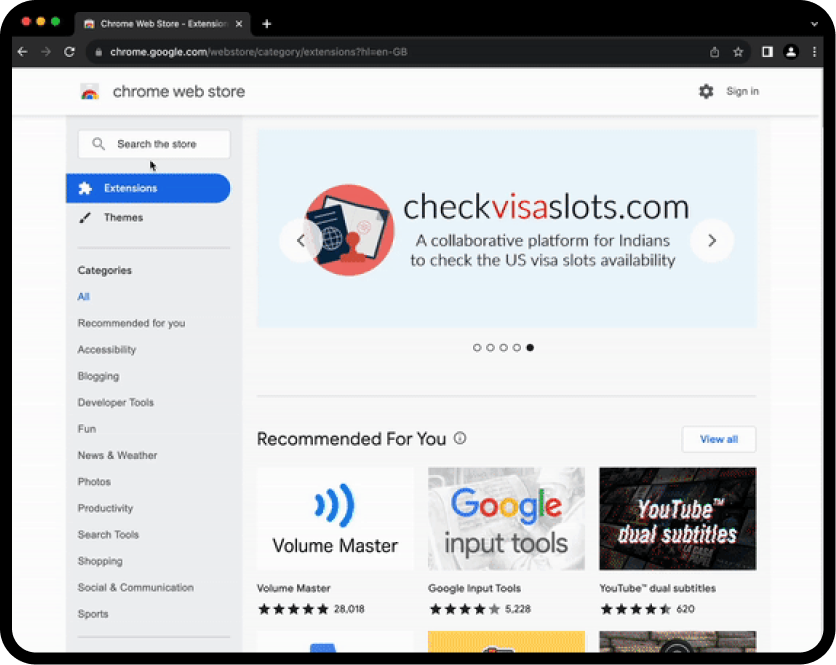

Built for accuracy and ease of use, the calculator offers options to export or share results, supporting efficient workflows. It adapts seamlessly across devices, ensuring reliable access whether on desktop or mobile devices. Stay compliant with local tax laws and leverage this tool for effective property tax management.

How to Use

1. Enter your property's assessment value.

2. Select applicable exemption type and property class.

3. Input the local mill rate.

4. Click the 'Calculate' button to see the results.

FAQs/Additional Resources

Find Quick Answers

How is the Bristol County property tax calculated?

Can I compare property taxes over different years?

What exemptions are supported?

Is this tool compliant with local tax laws?

Can I export or share my results?

User Reviews

See What Others Are Saying

Explore Related Tools

More Solutions for Your Needs

Thermal Insulation External Wall Calculator

An easy-to-use free online calculator for estimating external wall insulation requirements, helping architects and homeowners optimize energy efficiency.

IYY Calculator

An easy-to-use online calculator designed for accurate IYY scientific calculations for students and researchers.

Your Feedback Matters

Help Us to Improve

Norwegian

Norwegian

Danish

Danish

German

German

English

English

Spanish

Spanish

French

French

Italian

Italian

Dutch

Dutch

Portuguese

Portuguese

Swedish

Swedish

Hebrew

Hebrew

Arabic

Arabic